The Rise and Fall of the Flagship Killer: Why OnePlus Lost Its Edge

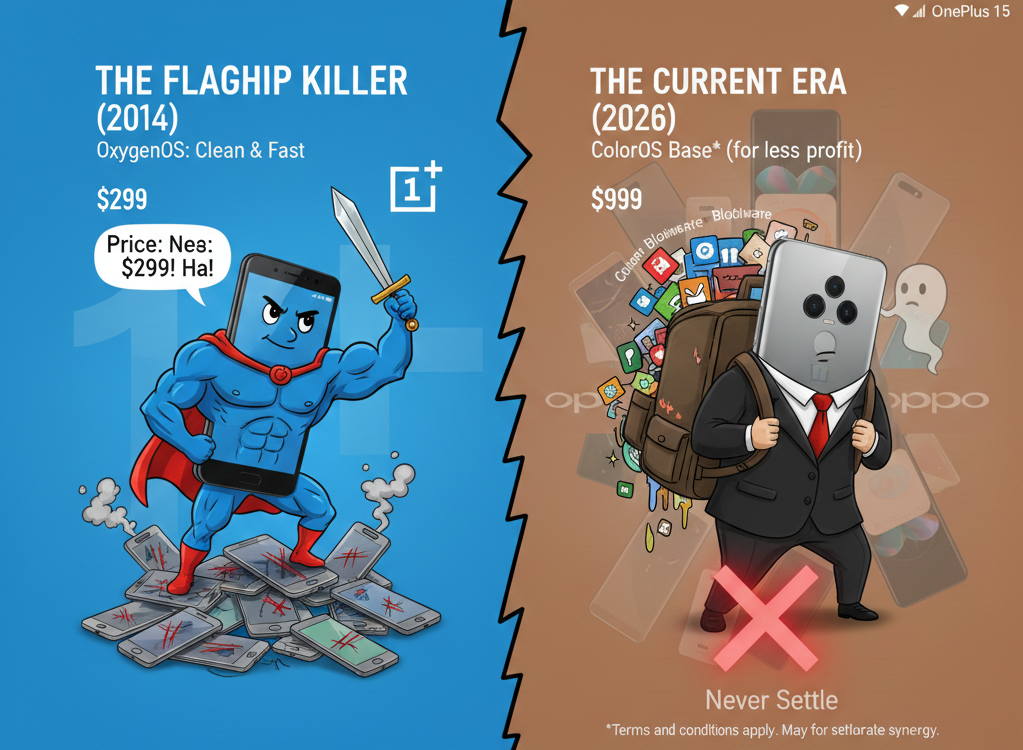

For nearly a decade, OnePlus was the “cool kid” of the smartphone world. Emerging in 2014 with the OnePlus One, the brand built a cult-like following by offering high-end specifications at half the price of a Samsung or Apple device. They didn’t just sell phones; they sold a rebellion against the “greed” of big tech under the defiant slogan: Never Settle.

However, by 2026, the landscape has changed. The disruptor has become the establishment, and in doing so, it has lost the very magic that made it a household name for enthusiasts. Here is how the “Flagship Killer” became just another face in the crowd.

The Merger: Losing the “Oxygen”

The most significant blow to the OnePlus identity was its 2021 “merger” with its parent company, Oppo. While the two had always shared supply chains, the merger saw OnePlus officially absorbed as a sub-brand.

The casualty of this union was OxygenOS. Once hailed as the best version of Android—clean, lightning-fast, and free of bloat—it was eventually merged with Oppo’s ColorOS. To the enthusiast community, this felt like a betrayal. The unique, minimalist soul of the phone was replaced by a software experience that felt indistinguishable from any other Chinese mass-market device.

The Death of the $300 Flagship

The “Flagship Killer” title was earned through aggressive pricing. When the OnePlus One launched at $299, it was a miracle of engineering and economics.

As the years passed, OnePlus followed a predictable corporate trajectory:

- Incremental Hikes: Prices crept up $50 at a time.

- Premium Parity: By the time we reached the 2024 and 2025 cycles, flagship OnePlus models were retailing for $800 to $1,000.

- The Value Gap: Once the price gap closed, the “killer” instinct died. Consumers found themselves asking: If a OnePlus costs the same as a Google Pixel or a Samsung Galaxy, why not just buy the brand with the better camera and longer support?

Dilution Through “Nord-ification”

OnePlus used to be a “one-phone-a-year” company. This focus allowed them to polish their hardware and maintain a sense of exclusivity.

In an effort to chase market share, they introduced the Nord line—a flurry of budget and mid-range devices. While these were commercial successes, they diluted the brand’s premium image. OnePlus went from being a “boutique performance brand” to a “department store brand,” leading to slower software updates and a fragmented user experience across their growing catalog.

A Crisis of Quality and Trust

In recent years, the hardware itself has faced scrutiny. The infamous “green line” display issues plagued several generations of devices, and in major markets like India, the brand has faced significant friction with retailers over profit margins and service support.

Furthermore, as of early 2026, the brand’s global presence has become a question mark. With rumors of scaling back operations in Europe and North America to focus on its domestic Chinese market, the “Global Disruptor” image has effectively been retired.

The Verdict: OnePlus didn’t necessarily “fail”—it still sells millions of units—but it did “settle.” It transitioned from a community-focused underdog to a corporate subsidiary. It stopped trying to kill flagships and decided to become a slightly more affordable version of one.